Smart Algo-Detector

Smart Algo Detector

The most effective way to use Optimal Ninja Quartz is with Smart Algo-Detector.

Weighting volume, speed-of-tape and price movement, Smart Algo instantly detects price levels where an algorithmic trade has hit and plots that position on your chart with an "O". Now, since ES/MES is awash with algos, we use some smart-filtering here to show you only the most relevant level on your bar.

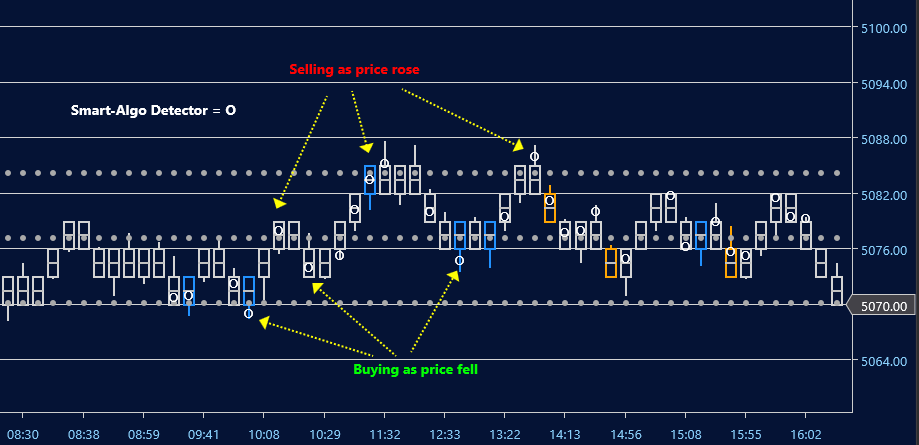

The simplest way to interpret these levels in real-time is that algos that trigger as price falls are buy programs and algos that trigger as price rises are sell programs .

The following chart is characteristic behaviour as price moved up and down in a range. Note how not only did Smart Algo Detector help inform entries, it was a pretty good warning-sign against buying on swing-highs and selling on swing-lows.

We typically see algos trigger at meaningful areas like session midpoint and 25% retracement levels off the highs and lows (the gray parallel dots on the chart) which are often warnings of reversals at these areas.

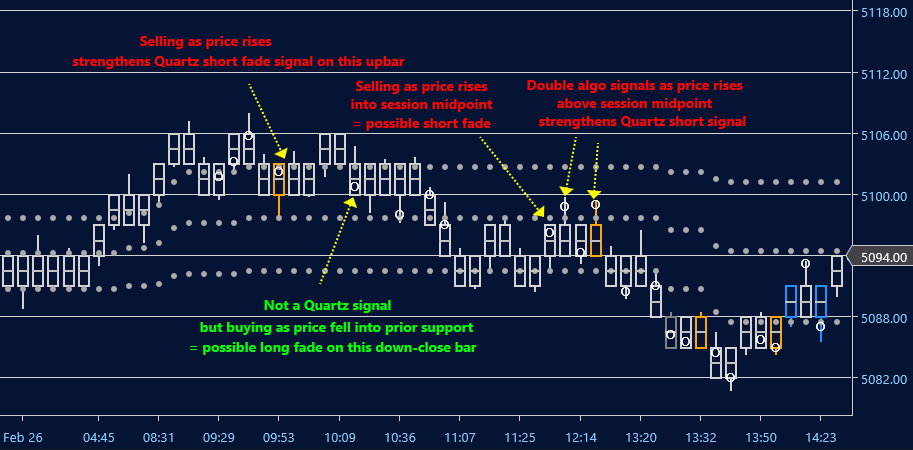

Watching Smart Algo Detector can help confirm Quartz signals and also help you find entries not specifically highlighted by Quartz, but which make sense in the context of the chart.

The following session demonstrates this:

We can also make deductions about the absence of program trades.

Does the lack of program-buying in a downtrend indicate the market has further to fall? Does the lack of buying on pullbacks in an uptrend indicate trend weakness? And what would happen if a cluster of overhead algo levels were breached by price moving higher?

These types of qualitative questions are always worth asking in live markets and we can gain deep insight into whether to hold or close our open trades by tracking live algo behaviour. This will covered in forthcoming videos.

For more information please see our FAQ.

Smart Algo-Detector included

with Optimal Ninja Quartz