NEW! - Optimal Renko Bars Pro

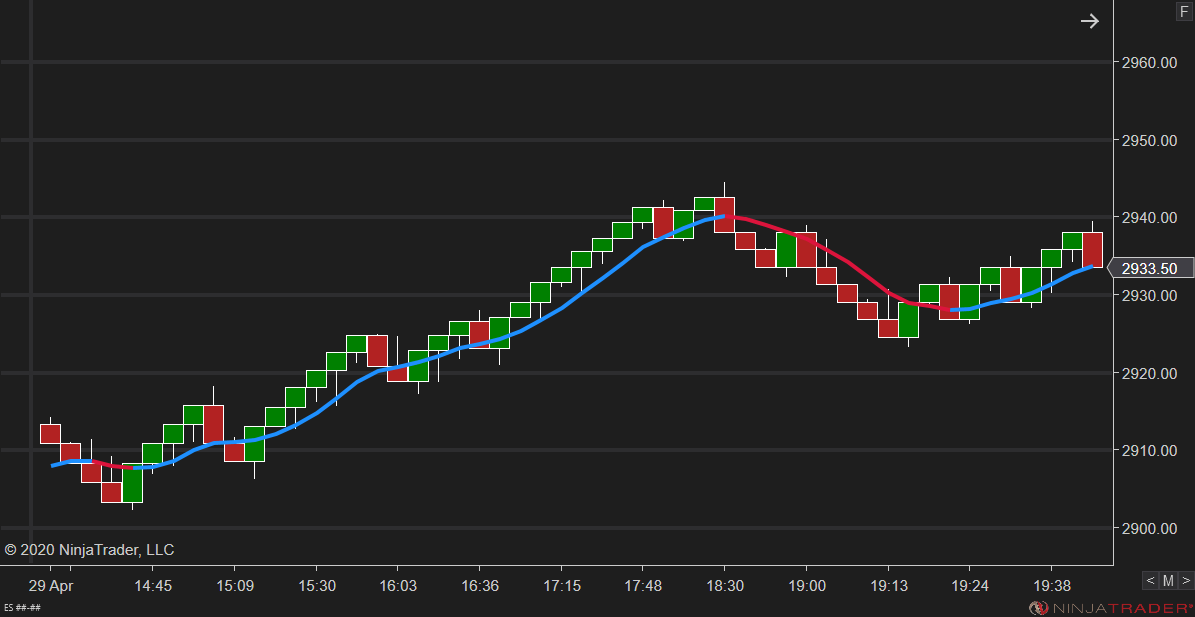

Optimal Renko Bars Pro is a revolutionary bar type that automatically selects the optimal size of renko bars on your chart -and adapts in real time.

If you’ve traded with renko bars in the past, you know their unique ability to filter market noise and reveal trends.

But you soon discover that the best renko 'brick' size changes from session-to-session, and even hour-to-hour. What worked beautifully in yesterday’s trend move finds you stuck in a tight cyclical market today with few opportunities, and poor risk-reward. This can mean either standing aside completely, or taking low-quality trades. Frustrating.

Optimal Renko Bars Pro

overcomes this challenge by using an adaptive-sizing algorithm that analyses multiple components of historical and live price action and dynamically changes the size of each bar in response to changes in volatility and trend. The result? Superior noise-filtering, highly-responsive charts.

And the

new 'Pro' version makes it simple to fine-tune the bars to your style of trading.

How it works

Simply set the three search parameters and let

Optimal Renko Bars Pro

find the best adaptive bar size,

in real time, as price changes.

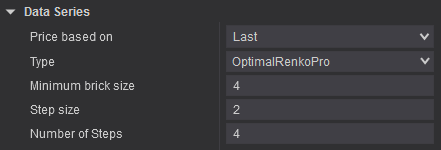

•

Minimum brick size

= the minimum bar size you wish to chart (e.g. 4 ticks)

• Step Size

= the increment that the logic examines (e.g. every 2 ticks)

• Number of Steps

= number of steps that the logic examines (e.g. 4 steps)

A setting of 4/2/4 will therefore compare bar sizes of 4, 6, 8, 10 and 12 ticks

and will automatically select the optimum fit for your charts –live.

And as the best-fit size changes during a live session, Optimal Renko Bars Pro

will automatically apply that change without you needing to do anything. Amazing!

Features of Optimal Renko Bars Pro

- Real Open/High/Low/Close for greater confidence in back-testing

Most renko bars use a synthetic bar open which creates attractive-looking charts but is useless for strategy-testing or price-action analysis, since frequently price didn't trade there. Our bars show the actual open price, so when price gaps between bars, you will see that on the chart.And, of course, the bars show the real high and real low with price wicks/tails.

- Choice of reversal bar types -either 1x, 2x or 3x reversal bar multipliers

You can choose to apply standard renko reversal sizes (a reversal bar is twice the height of a trend bar) or used equal-sized or three-times sized reversal bars.

- Complete flexibility to customize search parameters to your style of trading

Use narrow search parameters to fine-tune the best bar size for scalping, or select larger bar sizes for intraday swing trading. Or evaluate just two bar sizes (e.g. 5 ticks and 10 ticks) to find out which one is best at any point. Optimal Renko Bars Pro makes it simple to find the most effective chart.

- Works on all major futures markets / data feeds with historical tick data

Don't be fixed in your ways! Switch up to Optimal Renko Bars Pro.

Available now as part of Indicators Pack

Optimal Filter

Moving averages are often criticized for merely telling a story of the past. But those who study company reports to make investments are also drawing inferences from a historical narrative. In life, all we have is past data.

But accepting this doesn’t mean we can’t improve the probabilities.

Often traders add more than one average to a chart, or even multiple averages, hoping that a consensus of opinion will point the way. Lines curve across their chart in all directions like a Jackson Pollock painting. The message of the market becomes blurred; decision factors increase; discord replaces harmony.

One plot, multiple period lengths

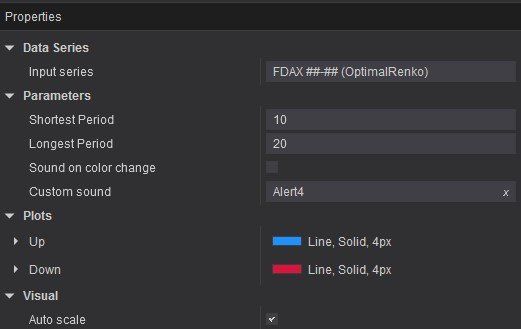

At

Optimal Ninja, we substituted multiple moving averages with a single plot that is able to determine the most appropriate lookback period.

On each bar,

Optimal Filter

analyses its prior effectiveness at isolating the dominant cycle length and recalibrates when this effectiveness changes.

Input-parameters are limited to the minimum and maximum period lengths that you wish the logic to consider.

As with

Optimal Renko

Bars, this means complex comparative analysis behind the scenes, but a single information stream on the chart.

Session Gaps

If you trade a market prone to session opening gaps, such as index futures, you will probably be familiar with your moving average spiking into empty space at the start of the day, a distance from the market.

Sometimes price action will even move to fill the gap and yet your average barely registers that reversal.

Large opening gaps can be so distortionary to price indicators that they can feel unfit for purpose. Of course, the logic is functioning correctly, but it functions best with contiguous data, not data sets that produce large outliers.

As with Optimal Renko

Bars, this means complex comparative analysis behind the scenes, but a single information stream on the chart.

Optimal Filter

mitigates this problem by incorporating

opening gap recognition

into its algorithm. This results in meaningful plots from the session open, which helps you make decisions based upon price action today, not yesterday. This is a crucial distinction.

Intraday trading favours those with tools that are sensitive to contemporaneous data.