Optimal Ninja Quartz

- Price action patterns

- Orderflow

- Volume

- Volatility

- Speed-of-tape

- Time-of-day

- Price action patterns

- Orderflow

- Volume

- Volatility

- Speed-of-tape

- Time-of-day

What does Quartz do?

Quartz is built around a powerful signal-processing engine capable of analysing multiple information-streams including:

- Price action patterns

- Orderflow

- Volume

- Volatility

- Speed-of-tape

- Time-of-day

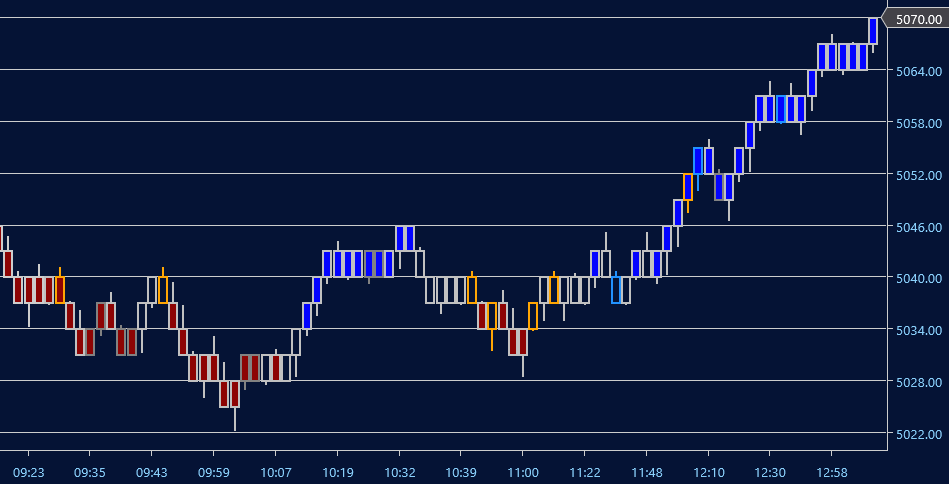

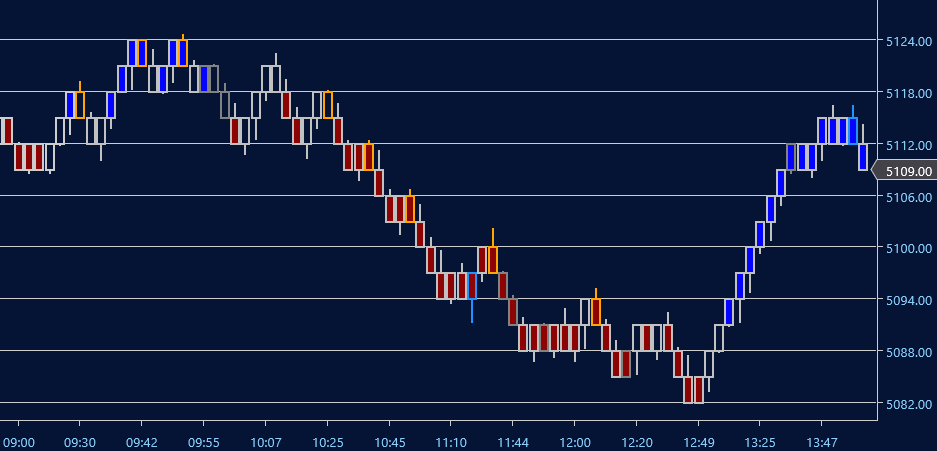

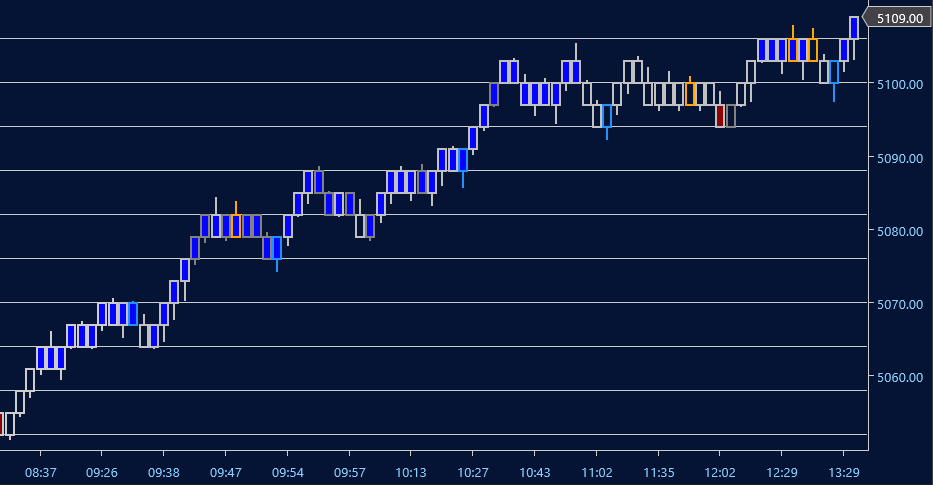

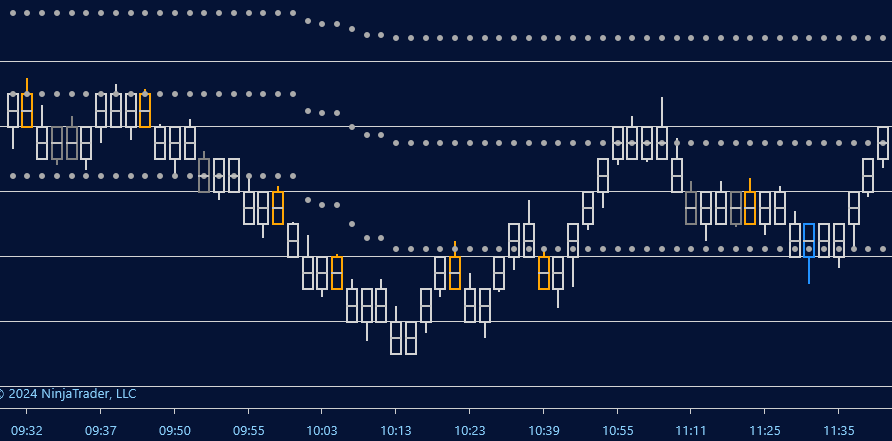

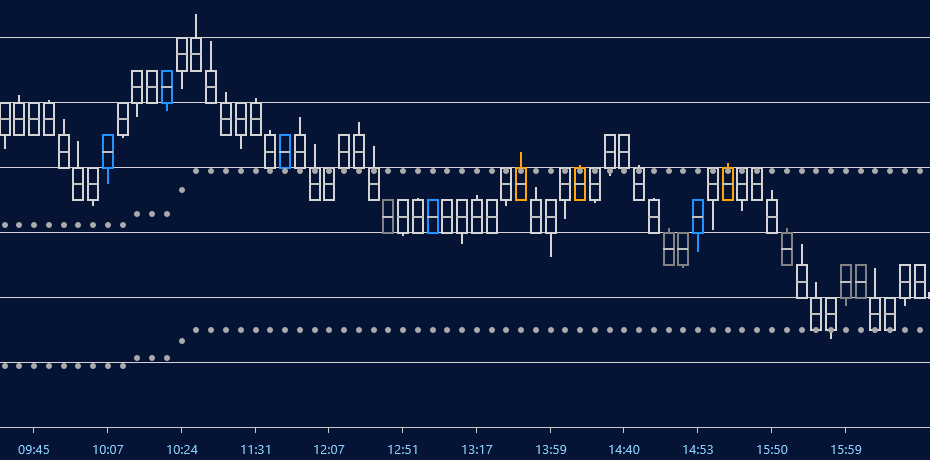

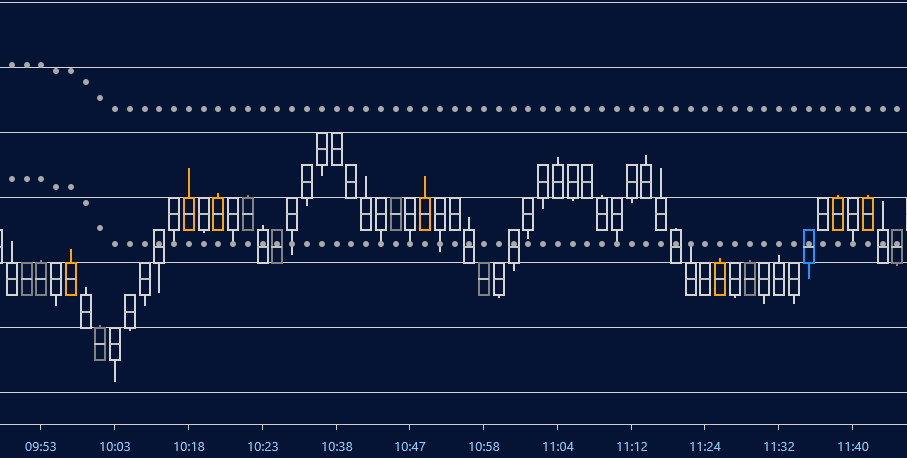

This data is then weighted according to our most successful trading simulations and when it identifies an exploitable-edge it sends a single color-coded signal to your price bars: long, short or stand-aside.

This level of real-time analysis is near-impossible for a human trader and gives you an immense edge in the decision-making process.

What signals does Quartz produce?

All trading with Quartz is built around the 12-tick system using

Optimal Ninja Snap ES Bars. Find out more

here

.

Quartz produces both momentum signals and fade (countertrend) signals and is smart enough to try to keep you out of the dumb trades that everyone takes from time-to-time, such as shorting a major uptrend or trying to buy the low of the day.

That isn't to say that all entries Quartz highlights will go in your favor. Of course not -Quartz is based on statistical analysis, not prediction. But experienced traders know the difference between a sound trade that doesn't work out and a bad trade they never should have taken.

So a significant element of Quartz's logic is assigned to filtering out low-probability setups. Bars that are gray-colored are stand-aside bars, where we recommend not entering.

For more information please see our FAQ.