Optimal Filter

Moving averages are often criticized for merely telling a story of the past. But those who study company reports to make investments are also drawing inferences from a historical narrative. In life, all we have is past data.

But accepting this doesn’t mean we can’t improve the probabilities.

Often traders add more than one average to a chart, or even multiple averages, hoping that a consensus of opinion will point the way. Lines curve across their chart in all directions like a Jackson Pollock painting. The message of the market becomes blurred; decision factors increase; discord replaces harmony.

One plot, multiple period lengths

At

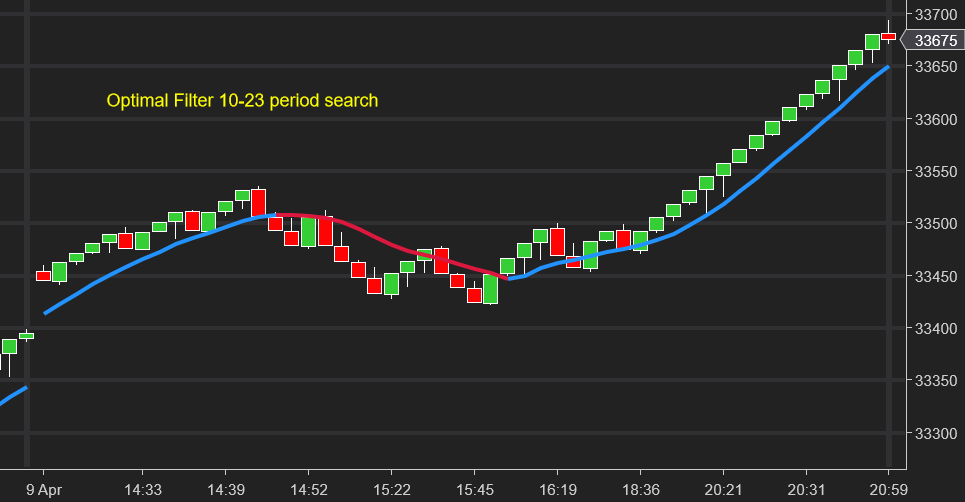

Optimal Ninja, we substituted multiple moving averages with a single plot that is able to determine the most appropriate lookback period.

On each bar,

Optimal Filter

analyses its prior effectiveness at isolating the dominant cycle length and recalibrates when this effectiveness changes.

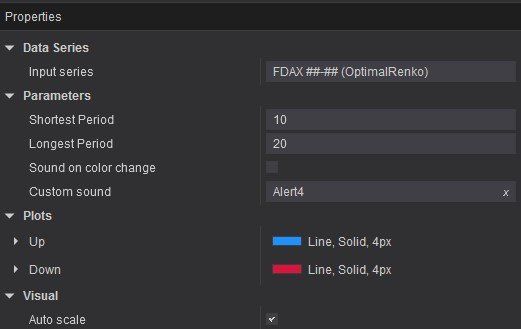

Input-parameters are limited to the minimum and maximum period lengths that you wish the logic to consider.

As with Optimal Renko

Bars, this means complex comparative analysis behind the scenes, but a single information stream on the chart.

Optimal Filter

Moving averages are often criticized for merely telling a story of the past. But those who study company reports to make investments are also drawing inferences from a historical narrative. In life, all we have is past data.

But accepting this doesn’t mean we can’t improve the probabilities.

Often traders add more than one average to a chart, or even multiple averages, hoping that a consensus of opinion will point the way. Lines curve across their chart in all directions like a Jackson Pollock painting. The message of the market becomes blurred; decision factors increase; discord replaces harmony.

One plot, multiple period lengths

At

Optimal Ninja, we substituted multiple moving averages with a single plot that is able to determine the most appropriate lookback period.

On each bar,

Optimal Filter

analyses its prior effectiveness at isolating the dominant cycle length and recalibrates when this effectiveness changes.

Input-parameters are limited to the minimum and maximum period lengths that you wish the logic to consider.

As with

Optimal Renko

Bars, this means complex comparative analysis behind the scenes, but a single information stream on the chart.

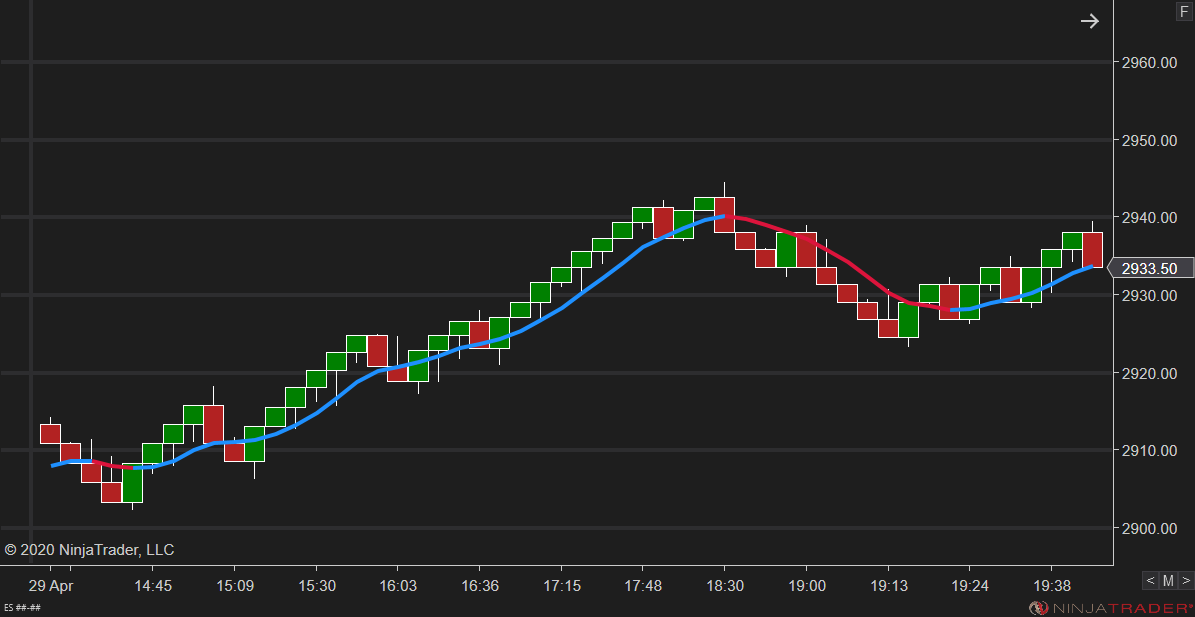

Session Gaps

If you trade a market prone to session opening gaps, such as index futures, you will probably be familiar with your moving average spiking into empty space at the start of the day, a distance from the market.

Sometimes price action will even move to fill the gap and yet your average barely registers that reversal.

Large opening gaps can be so distortionary to price indicators that they can feel unfit for purpose. Of course, the logic is functioning correctly, but it functions best with contiguous data, not data sets that produce large outliers.

As with Optimal Renko

Bars, this means complex comparative analysis behind the scenes, but a single information stream on the chart.

Optimal Filter

mitigates this problem by incorporating

opening gap recognition

into its algorithm. This results in meaningful plots from the session open, which helps you make decisions based upon price action today, not yesterday. This is a crucial distinction.

Intraday trading favours those with tools that are sensitive to contemporaneous data.

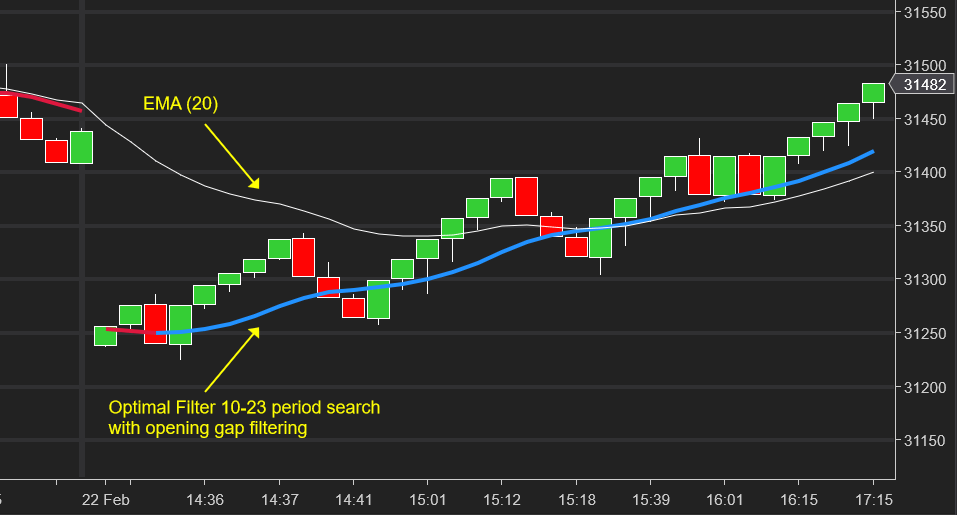

Session Gaps

If you trade a market prone to session opening gaps, you will probably be familiar with your moving average spiking into empty space at the start of the day, a distance from the market.

Sometimes price action will even move to fill the gap and yet your average barely registers that reversal.

Large opening gaps can be so distortionary to price indicators that they can feel unfit for purpose. Of course, the logic is functioning correctly, but it functions best with contiguous data, not data sets that produce large outliers.

Optimal Filter mitigates this problem by incorporating

opening gap recognition

into its algorithm. This results in meaningful plots from the session open, which helps you make decisions based upon price action today, not yesterday. This is a crucial distinction.

Intraday trading favours those with tools that are sensitive to contemporaneous data.