Optimal Ninja Snap Bars

Optima Ninja Snap ES Bars

Optimal Ninja Snap ES Bars are specifically built for 12-tick ES/MES scalping.

Although similar to renko bars, in that use they use a fixed open-close bar size, there's a crucial difference.

Rather than building from the opening price of each session,

Optimal Ninja Snap ES Bars

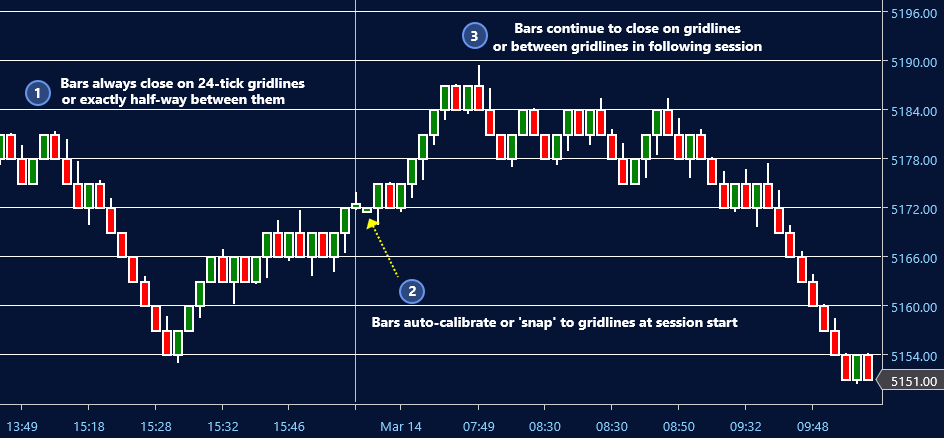

auto-align themselves with chart grid lines -so that the bars close at exactly the same levels across your chart.

No matter how many sessions you have charted, the bars will always close either exactly on fixed grid lines, or exactly half-way between them.

This modular approach has three distinct advantages when building scalping strategies:

1. Each bar now has a binary on-off condition attached -it either closed on a grid-line or it did not.

2. We can easily store and compare orderflow metrics at identical closing prices across multiple sessions.

3. Profit targets can be more-easily defined -the initial profit target is simply the next grid line.

During our strategy-modelling we tested all feasible Snap bar sizes and grid-line combinations. The clear winner was a bar size of 12 ticks and a grid-line increment of 24 ticks.

Above is a chart of Optimal Ninja Snap ES Bars without indicators. Price-action patterns such as trading ranges, breakouts, failed breakouts and reversals become much simpler to spot with Snap bars.

These 12-tick bars form the basis of Optimal Ninja Quartz and are the perfect balance between trade-frequency, execution and noise filtering.

For more information please see our FAQ.

Available now as part of

Optimal Ninja Quartz