Optimal Unfinished Auction

The concept of “unfinished auction” is generally less well-known than delta or volume profile but is nonetheless a useful tool, since it highlights a short-term imperfection in the market that can be used to build a game-plan.

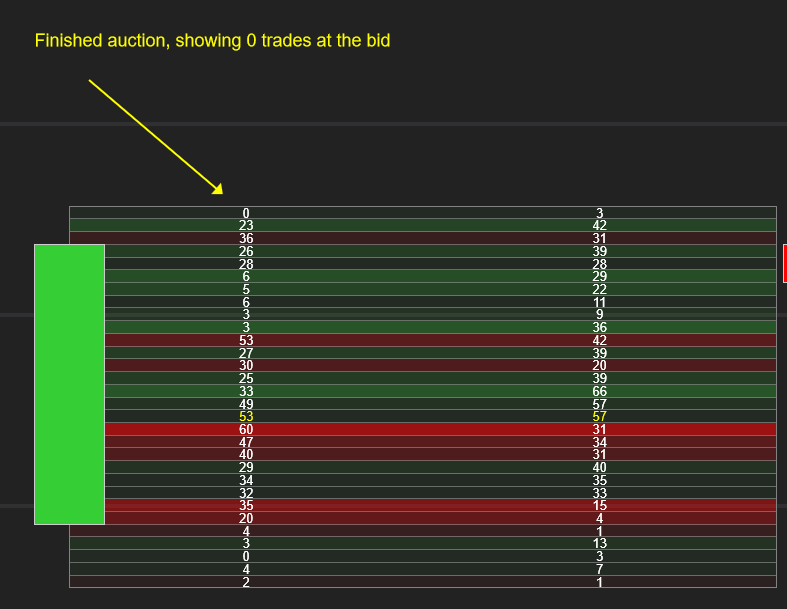

The underlying logic is simple. When a new high correctly forms, the end of the upward market auction is characterized by 0 contracts traded at the Bid (there are no more buyers).

Volumetric Bars showing a finished auction on the high of a bar

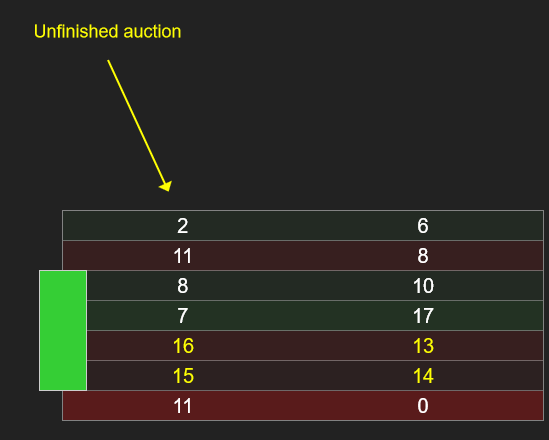

An unfinished auction occurs when the high has both buy and sell volume. The presence of bid trades at the high of a bar could mean that upward movement has not yet been exhausted and there is a probability that price will return to that level soon to complete the process.

Volumetric Bars showing an unfinished auction on the high of a bar

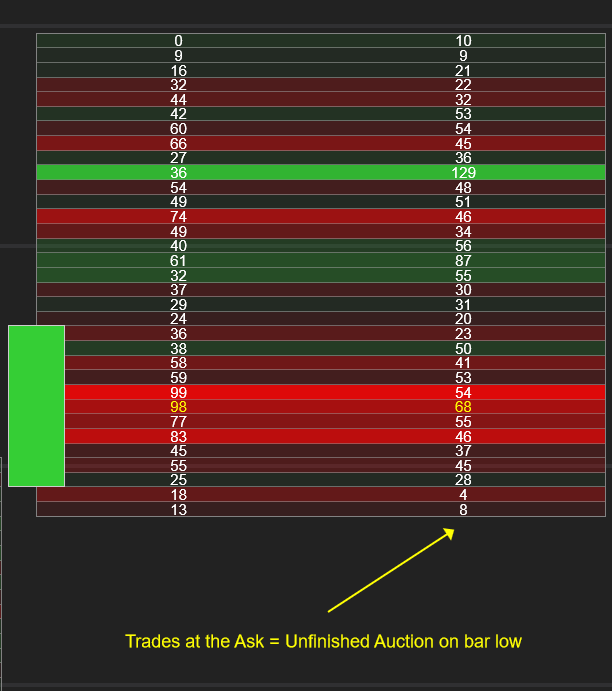

The converse applies in downtrends. The presence of contracts traded at the Ask on the low of the bar could indicate that the downward movement has not yet been exhausted and that price will return back down to that level.

Standard Volumetric Bars showing an unfinished auction on low of bar

Optimal Unfinished Auction

auto-highlights these areas on a bar without needing to overlay footprint bars or to manually track bid/ask numbers. This makes it very easy to bring unfinished-auction information to your trading.

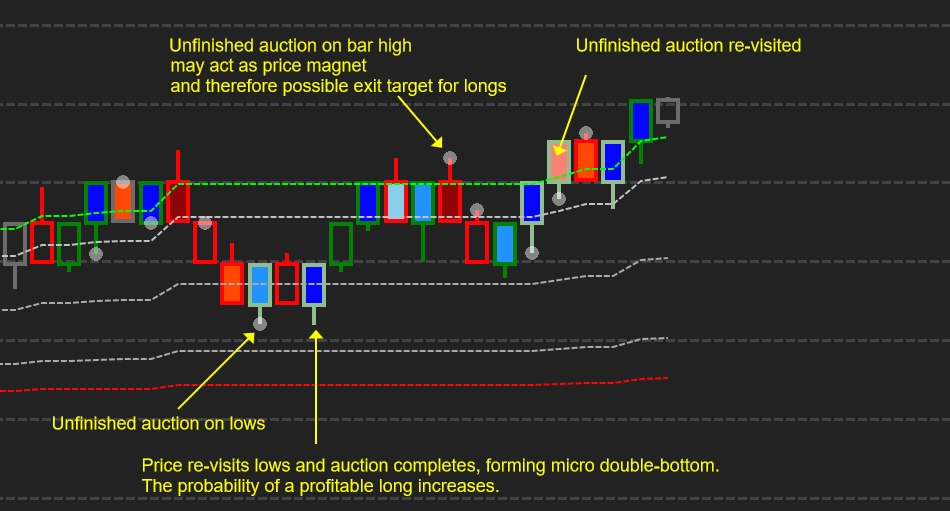

The following chart illustrates how these levels can act as price magnets which can help us with trade planning:

Optimal Unfinished Auction shows that unfinished auctions frequently act as price magnets.

Optimal Unfinished Auction

The concept of “unfinished auction” is generally less well-known than delta or volume profile but is nonetheless a useful tool, since it highlights a short-term imperfection in the market that can be used to build a short term game-plan.

The underlying logic is simple. When a new high correctly forms, the end of the upward market auction is characterized by 0 contracts traded at the Bid (there are no more buyers).

An unfinished auction occurs when the high has both buy and sell volume. The presence of bid trades at the high of a bar could mean that upward movement has not yet been exhausted and there is a probability that price will return to that level soon to complete the process.

The converse applies in downtrends. When there are no more contracts traded at the Ask on the low of a bar, the auction is finished since there are no more sellers. The presence of contracts traded at the Ask on the low of the bar could indicate that the downward movement has not yet been exhausted and that price will return back down to that level.

Optimal Unfinished Auction

auto-highlights these areas on a bar without needing to overlay footprint bars or to manually track bid/ask numbers. This makes it very easy to bring unfinished-auction information to your trading.

The following chart illustrates how these levels can act as price magnets which can help us with trade planning: